Sasol Faces Huge Loss Amid Market Challenges and Strategic Reorientation

2024-08-20 08:27:58 | By Staff Writer

Tom Corser | Source: Wikimedia Commons

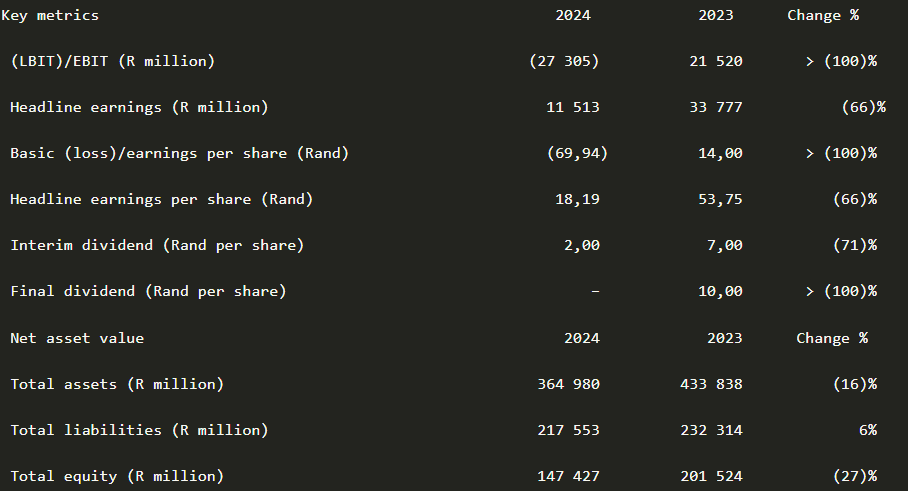

Sasol, the South African fuel and chemicals behemoth, has reported a significant R44 billion loss for the financial year ending June 30, 2024. This marks the company’s first loss since 2020, underscored by a massive R75 billion impairment charge, primarily related to its operations in the United States and South Africa.

A Year of Unprecedented Challenges

The company’s financial performance in FY24 was heavily impacted by a mix of challenging market conditions, including constrained margins, depressed chemical prices, and an overall volatile economic environment. Sasol's turnover fell by 5% to R275.1 billion, reflecting the pressures on its core business. Despite these challenges, the company managed to mitigate some of the adverse effects through a stronger rand oil price, improved refining margins, reduced operational costs, and higher sales volumes. However, these positive developments were insufficient to counterbalance the deep impairments and the overall market instability.

Massive Impairments: A Deep Cut

The most significant portion of the impairment, amounting to R46 billion, was tied to Sasol’s Chemicals America ethane value chain. This impairment was driven by prolonged softer market pricing and a less favorable outlook for these products.

Additional impairments included a R5.7 billion write-down on the Secunda liquid fuels refinery and further impairments across the Chemicals Africa division, particularly in the Polyethylene value chain, where oversupply and reduced global demand further eroded asset values. In comparison to the previous year’s impairments of R33.7 billion, the FY24 impairments more than doubled, highlighting the severity of the challenges faced by Sasol in the current economic climate.

Strategic Shift Toward Gas: A New Direction

In response to these challenges, Sasol’s newly appointed CEO, Simon Baloyi, who assumed the role in April 2024, has outlined a strategic pivot toward expanding the company’s gas business. Baloyi’s strategy includes leveraging growth by extending gas supply to more than 300 customers in South Africa and generating electricity with natural gas—a stark contrast to the previous leadership’s approach, which deemed liquefied natural gas imports as too costly.

This strategic shift is integral to Sasol’s broader goal of reducing its greenhouse gas emissions by 30% by 2030. The company aims to replace 40 million tons of coal, its primary feedstock, with natural gas and renewable energy sources. To this end, Sasol has signed contracts for 750 megawatts of renewable energy supply, with a target of utilizing 1,200 megawatts of clean energy at its South African operations by 2030. However, challenges such as South Africa’s grid limitations and the high cost of green hydrogen—a potential future energy source—pose significant hurdles.

Financial Consequences: Dividend Policy Revision and Debt Concerns

The immense impairments and resulting financial loss have forced Sasol to revise its dividend policy, leading to the decision not to issue a final dividend for 2024. The company’s full-year dividend has plummeted by 88%, from 17.0 cents per share in FY23 to just 2.00 cents per share in FY24. This decision was also influenced by Sasol’s "elevated" net debt, which stands at $4.1 billion, reflecting the financial strain on the company as it navigates this challenging period.

Source: MoneyWeb

Looking Ahead: Stabilization and Long-Term Goals

As Sasol looks to the future, its immediate focus will be on stabilizing its core operations and executing its gas expansion strategy. The company remains committed to its long-term goal of achieving net-zero emissions by 2050, which includes exploring the potential of green hydrogen and other clean energy technologies. However, the path ahead is fraught with challenges, including the need to balance financial stability with the pressing demands of climate change and the global energy transition.

Sasol’s journey in the coming years will be closely watched as it seeks to regain its footing in a rapidly changing energy landscape while addressing both its financial and environmental responsibilities.